The long-troubled RIM (Research in Motion) saw a boost in share price thanks to its possible acquisition by Lenovo. On January 24, RIM shares rose by 3 percent to close at $17.80 on the Toronto Stock Exchange.

The long-troubled RIM (Research in Motion) saw a boost in share price thanks to its possible acquisition by Lenovo. On January 24, RIM shares rose by 3 percent to close at $17.80 on the Toronto Stock Exchange.

It may seem like a small increase, but RIM is certainly grateful for any turnaround it receives. The mobile electronics company once had a stock price of $150, but these days it cannot rise above the $17 range. The tick of new interest is small because investors are reacting to only a vague possibility. The CFO of Lenovo, Wong Wai Ming, told Bloomberg that Lenovo had talked with RIM about possible strategic ventures and that “We are looking at all opportunities — RIM and many others.”

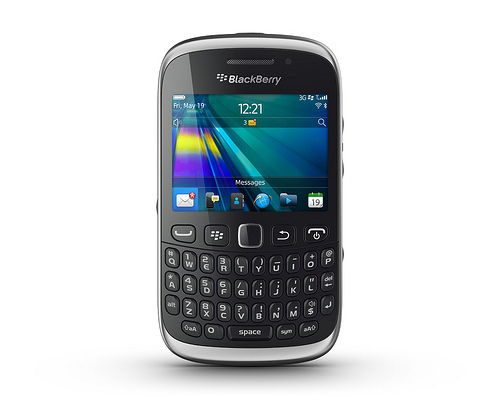

A potential acquisition strategy that might include RIM is far from a shot in the arm, but investors (including a large number of short sellers waiting for RIM shares to fail) and analysts alike were buoyed by the news. The CEO of RIM has already stated that the company will consider strategic decisions such as the sale of the company, especially after its release of the Blackberry 10 in late January. Other plans, such as its mobile payment deal with Visa, have long-term potential that could catch the eye of companies in the mood for mergers and acquisitions.

A little over a decade ago, RIM was sitting happily at the top of the mobile phone and personal assistant device industry with its famous Palm and Blackberry lines. Every cutting-edge office wanted to invest in the new smartphone technology. But just when consumers became accustomed to pulling out a stylus, Apple happened — followed by Samsung, Google and Microsoft, each with their advanced phone designs and all-in-one devices. By the time the age of the tablet arrived, RIM had been left by the wayside.

Research In Motion has attempted to stay relevant with more updated Blackberry models, but the company has been struggling for years, faced with challenging competition on one side and unhappy investors on the other. If the computer giant Lenovo does make a move, the Canadian-based RIM could look forward to reinvention as a services or retail electronics company. RIM has been hesitant to expand into China in the past due to the volatile nature of China’s Internet and the security risks associated with it, but an acquisition would leave the company no choice.

The performance of the Blackberry 10 will decide much for both RIM and Lenovo — and stock prices will react accordingly. Sales of the iPhone 5 have been booming, but Apple is receiving skeptical looks in the investment world these days. RIM could have one last shot at success.

[cf]tracking[/cf]

No Comment