In a nutshell: Financial formulas, such as inventory turnover, average collection period and profitability, provide valuable insight into how well your small business is performing — and whether you need to take corrective action.

Sometimes, it’s hard to know if your business is in trouble before it’s too late. Seemingly without warning, the warehouse is overflowing, there’s no cash, and you can’t figure out if the entire enterprise is profitable. Fortunately, there are a handful of financial ratios that can serve as the proverbial canary in the coal mine — alerting you to possible problems while it might still be possible to address them.

The three measures provided here are easy to calculate from your income statement and balance sheet. Poor results from any of these three might be a red flag.

A friendly disclaimer: You should consult with a financial expert before making any important business decision. This is good advice for any content you discover on the internet. Thrive, a small business resource provided by ADP, provides some tips for finding a finance expert. If you have a publicly traded company, or are thinking about going public in the future, consult the SEC’s Small Business Compliance Guides.

Red Flag 1: Low Inventory Turnover

If you’re in the business of selling things, especially in a retail setting, you probably have to maintain an inventory of goods. Fortunately, it’s possible today to keep tight reins on inventory, thanks to advanced logistics and just-in-time delivery. Nonetheless, to meet your customers’ needs immediately, you have to make sure you have inventory to sell.

While small businesses must always mind the size of their inventory — after all, warehouse space is an overhead cost — they should also know how many times inventory is turned over in the course of one year. A slow turnover rate may indicate that sales are lagging, or that the inventory mix needs to be adjusted.

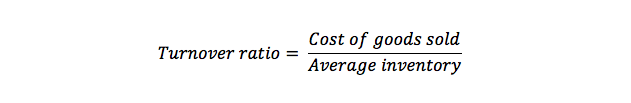

To determine your inventory turnover rate, you’ll need to divide your cost of goods sold (found on the income statement) by the value of your inventory (found on the balance sheet). The figure indicates how often your inventory is sold or used over the span of one year.

The tricky part about using inventory turnover rates is figuring out if the number you calculate is cause for alarm. To do that, you’ll need to find the inventory turnover rates for peer companies in your industry. CSIMarket.com, a media firm that conducts financial research, publishes averages for entire sectors. CSIMarket found the average inventory turnover rate for retail is 11.39 times, and for technology is 7.83 times.

Red Flag 2: Long Collection Periods

Even if you send out bills like clockwork, it’s hard to predict when the payments will come back. That can put a strain on your company’s cash flow, which can be particularly difficult for small businesses without much cash to begin with.

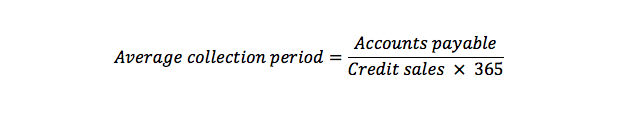

It’s not difficult to work out how long it takes to be paid. First, divide your credit sales figure (found on the income statement) by 365. Then, divide your accounts payable figure (found on the balance sheet) by the number you just calculated. The resulting number is the average of how long it takes to receive money once you have recorded the sale.

You want to see how well your average collection period compares to your credit terms. If you’re offering your customers net 30 days to pay their bills (which is customary) and the average collection period is higher, perhaps it may be time to get more stringent with collections.

Red Flag 3: Lack of Profitability

Without some calculations, it’s difficult to tell whether your small business is profitable. You might feel profitable when the balance on your bank statements is large, but that figure can be deceiving because nearly all businesses use accrual accounting (revenue is reported when it’s earned or when the expense occurs), not cash accounting (revenue is reported when it is received or when the expense is paid).

There are several ways to determine profitability, but the most commonly used one is net profit margin. This figure shows how much money a company is producing in relation to sales. To start, add together the net income, which is equal to revenue less cost of goods sold, operating expenses, other expenses, interest and taxes. Then, divide this number by revenue.

If your net income is 25%, it means that you’re keeping a quarter for every dollar you make in sales.

If you’re spending more than you’re selling as you get your business off the ground, don’t be surprised if these numbers are negative. However, if you’ve reached a point where you should be profitable, you might need to find ways to boost sales or reduce expenses.

Rely on Experts

These numbers are a good starting point, as they are easy for anyone to calculate, but there are many other financial formulas that are useful for small businesses. Rely on a financial expert — whether he or she is in-house or an external consultant — to help with additional formulas related to profitability, activity, leverage and liquidity. Be sure to ask for the insight and context that will help you understand what the numbers are and what they mean.

Keep the conversation going: What financial formulas do you use to monitor the health of your small business? Let us know in the comments.